.png?width=410&height=214&name=Dec%20Blog-%20Bob%20(1).png) As I write this, stations we work with are running open in Prime. This trend isn't novel, having manifested itself since the onset of the pandemic. It's imperative to grasp the extent of this decline to adeptly navigate our pricing strategy in the times ahead. Although 2024 in specific markets holds promise with additional political demand, capable of plugging some gaps, a contingency plan is essential if this political demand fails to materialize, maximizing revenue amid a diminishing daypart.

As I write this, stations we work with are running open in Prime. This trend isn't novel, having manifested itself since the onset of the pandemic. It's imperative to grasp the extent of this decline to adeptly navigate our pricing strategy in the times ahead. Although 2024 in specific markets holds promise with additional political demand, capable of plugging some gaps, a contingency plan is essential if this political demand fails to materialize, maximizing revenue amid a diminishing daypart.

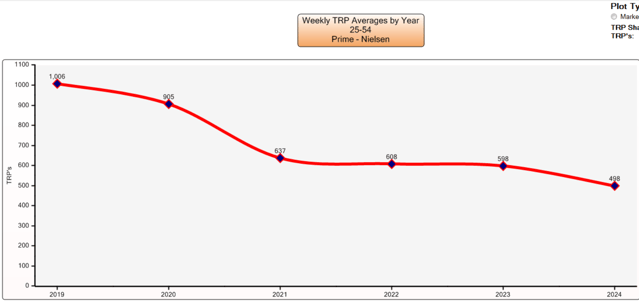

To put things into perspective, consider the chart below, depicting the annual average weekly Adults 25-54 rating points in a representative market. While this represents just one market, the observed pattern is largely replicated across the ShareBuilder database. The primary takeaway is that we cannot anticipate being purchased at the same rates as 2020 or even 2022. Despite Prime point levels decreasing, logic would suggest that Cost Per Points should rise. However, this isn't the reality; we are fortunate if CPPs remain static year over year. Given this understanding, difficult decisions must be made regarding pricing the Prime daypart.

This is where the concept of elasticity of demand becomes crucial. Each network boasts a select few highly sought-after Prime programs for which advertisers make specific requests. We want to ensure that advertisers with unreasonably low "need rates" don't gain access to these programs. Likely, other advertisers are willing to purchase the same inventory at a more reasonable rate. Yet, similar to other dayparts that face underutilization, we must decide the acceptable rate and when to disengage. Understanding the extent of elasticity in the buyer's demand affords us two straightforward strategies. Suppose our assessment suggests the buyer's demand is inelastic, meaning they ardently require a specific program to meet their objectives. In that case, we should set the price as high as possible, approaching the point where the buyer threatens to walk away. Conversely, if the buyer's demand is elastic, we negotiate a share of the business based on a lower rate.

Prime inventory no longer holds the same value as it did in the past. Recognizing this fact is crucial for identifying and formulating our pricing strategies moving forward.

.png?width=1001&height=107&name=ShareBuilders%20Logo%20(07052023).png)