Welcome to the next episode of Heads Together - your go-to source for insights and information on the latest trends in the media sales industry. Our video series explores the most pressing topics and challenges facing media sales professionals today. We pair our consultants and clients to share their perspectives and advice on issues like pricing strategies and building solid client relationships.

Heads Together - Episode 2

Nov 8, 2023 2:05:19 PM / by Rachel Sprenkle posted in Media Sales, ShareBuilders, Industry News, Radio, TV

Crack the Code of Pricing Success: Harnessing Sharebuilders' Holding Capacity Model

Oct 25, 2023 4:00:00 PM / by Mark Bretsch posted in Media Sales, ShareBuilders, TV

Effective pricing is the cornerstone of a successful broadcasting business. In this regard, ShareBuilders' Holding Capacity model emerges as an invaluable tool for understanding the present and shaping the future of your revenue streams. At its core, this model offers insights into what your equitable share of revenue should be for a specific quarter or even an entire year. However, delving deeper into its intricacies can grant you a distinct competitive edge, enabling you to discern precisely where you wield pricing power and where it may be more limited. Guided by a dedicated ShareBuilders consultant, you can navigate this model to your advantage.

Mastering Rate Card Best Practices: Insights from a Consultant

Oct 18, 2023 3:15:00 PM / by Anita O'Neill posted in Media Sales, ShareBuilders, Radio, TV

What is the best way to share rates with your sellers? First, it’s imperative to call the demand in the market to ensure we are pricing to optimize revenue based on current conditions. ShareBuilders has fantastic tools that can help you determine a realistic forecast based on history while also evaluating the current business climate. Next, you need to assess your people’s ability to negotiate. Do you have an experienced team, or is their first inclination to dive to the lowest level?

Automating Lead Management with Zapier & ShareBuilder CRM

Oct 11, 2023 3:15:00 PM / by Taylor Snow posted in ShareBuilders, Customer Success, CRM, Account Management

In today's digital age, managing leads has become an increasingly complex challenge for companies. This is where our recently released Lead Management system, steps in. And the cherry on top? We've integrated Leads and Contacts with the entire Zapier platform. Zapier is a solution that allows our customers to automate parts of their workflows by connecting the apps they already use every day with ShareBuilder CRM.

Shift into Park: How the Automotive Strike is Steering Television Ad Spending

Oct 4, 2023 3:04:37 PM / by Bob Swinehart

Ladies and gentlemen, start your engines, but maybe don't rev up just yet! The automotive industry is revving its engines in a whole new way, causing quite a stir in the world of television advertising. Buckle up because we're about to take a joyride through the twists and turns of how the automotive strike affects television ad spending.

Precision Pending, ShareBuilder AI

Sep 28, 2023 6:00:00 AM / by Taylor Snow posted in Media Sales, Features and Updates, ShareBuilders, Customer Success, CRM, Industry News, Radio, TV

The Problem We Are Solving

In the ever-changing world of media sales, forecasting accuracy is crucial. However, we've observed a persistent gap between pending dollars and related booked revenue. Our data analysis has revealed that pending dollars can be consistently off by as much as 160% compared to what sales teams actually close at the end of each month.

This discrepancy is a consequence of various factors. Sales reps have different ways of approaching their pending dollars: some are constantly overconfident, or projecting higher closing rates; others may procrastinate in entering their pending deals into the system; and still, others might have an inflated expectation from certain accounts.

These factors and others culminate in an inflated pending amount, leading to a substantial divergence between the forecasted and actual revenue. Such inaccuracies can affect the strategic planning and decision-making process at various levels, ultimately impacting our customer’s bottom line. It is this very problem that we aim to help solve.

Our Understanding

With over 20 years of experience in creating CRM solutions specifically for the media sales industry, our expertise at ShareBuilders is informed by an extensive understanding of the unique challenges and needs of this sector. Throughout these years, we've engaged in comprehensive competitor analysis, direct interaction with our customers, and meticulous study of sales rep behaviors.

We've observed that the human element can add unpredictability to forecasting. After trawling through vast datasets of pending deals and sales team performances, we've gained a profound understanding of how pending dollars are managed, and more importantly, how they could be estimated better. This insight into the intricacies of the sales process and the industry's unique needs has become the springboard for the development of our groundbreaking feature, Precision Pending.

Precision Pending

This is just a preview of the decisions and understanding that led us to develop Precision Pending, a revolutionary feature of ShareBuilder AI. This tool is powered by machine learning, custom data modeling, and our proprietary algorithms. Unlike traditional methods, Precision Pending takes into account diverse factors, such as the sales rep's pending precision, pending trends, and the account's history, among others. By integrating these factors into the pending process, Precision Pending offers a more reliable and accurate view of pending dollars. This AI-driven solution brings more predictability to the process, mitigating the uncertainties associated with human predictions. With Precision Pending, we're taking a significant stride toward empowering our customers with the ability to predict revenue more accurately and consistently.

A Commitment to Continual Improvement

At ShareBuilders, we believe in constantly pushing the boundaries to empower our customers. That's why we're proud to announce that we're releasing Precision Pending to all of our customers at no additional cost. We see this as a collaborative journey where we learn, grow, and innovate together.

Our initial models project that Precision Pending can help reduce uncertainty between 30-50% from raw pending dollars. This is a significant stride towards helping sales teams to more reliably forecast revenue, but we do not intend to stop there.

As we continue to roll out this feature, we'll carefully monitor its performance and listen to our customers' feedback. Our aim is not only to improve Precision Pending but also to ensure that it continually adapts to the changing realities of media sales.

This is a significant milestone in our journey toward helping companies with confident revenue predictions. We believe that through persistent efforts and close collaboration with our customers, we can continually narrow the gap of uncertainty and revolutionize the media sales landscape. We are excited about the road ahead and hope you are too.

Welcome to the future of forecasting with Precision Pending.

ShareBuilder AI Announcement

Sep 27, 2023 11:11:32 AM / by Taylor Snow posted in Media Sales, Features and Updates, ShareBuilders, Customer Success, CRM, Industry News, Radio, TV

For over twenty years, ShareBuilders has been a beacon of innovation, powering some of the nation's largest media brands with game-changing solutions. As media sales continue to transform, we're not just adapting; we're redefining what it means to furnish state-of-the-art pricing and sales analytics tools, enhanced by our team's unrivaled depth of industry expertise.

As AI reaches a pivotal stage in its evolution, we are harnessing its potential in alignment with our mission statement - we make your data make sense. This commitment propels our mission to deliver solutions that don't just follow trends but set them.

We view AI not merely as a tool, but as a technology capable of forever reshaping the landscape of media sales. At ShareBuilders, AI is more than a buzzword; it's a path to create compelling benefits for our customers, offering a unique blend of assistance, enhancement, and empowerment. Its potential to address the industry's most daunting challenges and unlock new avenues of opportunity is unprecedented, promising to reimagine everything from routine tasks to the most creative and forward-thinking initiatives.

Announcing ShareBuilders AI

We're thrilled to unveil ShareBuilders AI, a groundbreaking suite of features designed to elevate the capabilities of the ShareBuilders Platform. These new AI-powered functionalities will extend across CRM and Pricing experiences, delivering all-new data insights faster and more reliably than ever before. ShareBuilders AI encompasses a wide range of artificial intelligence (AI), machine learning (ML), and highly complex proprietary algorithms.

Guided by Our Approach to AI

As we venture on this transformative journey, we remain steadfast in our guiding principles of Accountability, Transparency, Inclusiveness, and Purpose. Our commitment to these values ensures that ShareBuilders AI solutions are not just technologically advanced but also accountable and transparent in their implementation.

Read Our Approach to AI

AI Designed for Transparency

To signify the presence of ShareBuilders AI within our platform, we're introducing a new system-wide design language. ShareBuilders AI features are distinguished by a unique icon and purple coloring, providing customers with immediate transparency and a clear indication of AI implementation.

"With ShareBuilders AI, we're disrupting our industry by delivering cutting-edge solutions and capabilities and becoming the most all-encompassing media sales platform on the planet."

-Chris Koller, ShareBuilders VP of Sales & Marketing

Our AI Journey Has Just Begun

With ShareBuilders AI, we're merely scratching the surface of what's to come. Look forward to the ShareBuilder AI features, including Precision Pending, Rate Impact, Forecasting, and many more, as we continue to drive the future of media sales solutions.

Stay tuned for our upcoming blog series that will delve into each new ShareBuilders AI feature, unveiling how they can enhance your media sales operations like never before.

Welcome to the future of media solutions with ShareBuilders AI, only available on the ShareBuilder Platform.

New ShareBuilders Feature - Rate Details In Our Pricing

Sep 20, 2023 2:34:22 PM / by Bill Witsik posted in Features and Updates, ShareBuilders, Radio, TV

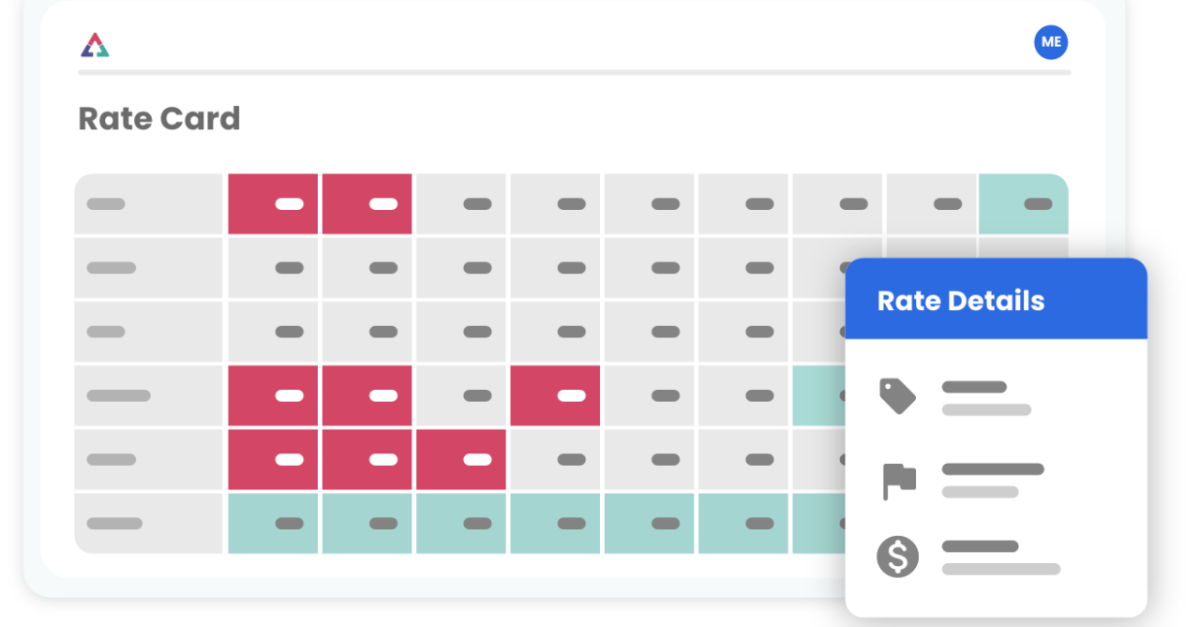

There’s no question the new and improved ShareBuilder Platform looks sharp, but it also contains a key new feature that can benefit sales managers. The new Pricing feature is called Rate Details, and it can be found on the Rate Card tab.

The Future of Media Sales Efficiency: ShareBuilders Announces New Platform

Sep 12, 2023 8:00:00 AM / by Rachel Sprenkle posted in Media Sales, Features and Updates, ShareBuilders, Radio, TV

Our Approach to AI

Sep 5, 2023 11:07:40 AM / by Taylor Snow posted in Media Sales, Features and Updates, ShareBuilders, Industry News, Radio, TV, OOH

For over 20 years, ShareBuilders has been a pioneer in leveraging data to empower media companies with data-driven decisions. As the landscape of media sales undergoes constant change and transformation, we recognize the need to pivot ahead and meet the demands of our customers and their industries. Embracing the defining technologies of our time, artificial intelligence (AI), and machine learning (ML), we are committed to a balanced approach, staying grounded in practical AI solutions that deliver meaningful benefits to our valued customers.

.png?width=1001&height=107&name=ShareBuilders%20Logo%20(07052023).png)